Insights

Little Known Current Facts About U.S. Equity Investing

Featured

Little Known Current Facts About U.S. Equity Investing

Latest

All Articles ()

There are currently no articles for this filter

KEY POINTS

1. On a three-year annualized basis, value is outperforming growth by over 3%.

2. Seeking out undervalued securities has continuously paid off for the past century.

3. We look beyond how the "Magnificent Seven" have lived up to their name this year.

Boston - In our travels meeting with clients and prospects, we found that many who believed at the end of 2022 that value was set to continue to outperform growth for longer have been disappointed in this year's growth surge.1 They believe 2022 was the anomaly, with some even claiming that value investing is dead and allocating only to core or growth U.S. equities.

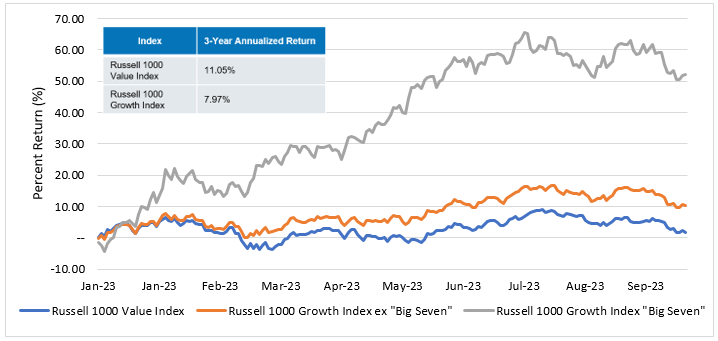

Looking under the hood, the "Magnificent Seven"2 have lived up to their name this year. However, when you look closely at the Russell 1000 Growth Index, ex the seven heavyweights, the story becomes more surprising. Without the Magnificent Seven, the Growth Index's returns are far more like those of the Russell 1000 Value Index so far in 2023. Therefore, beyond those seven behemoths, the market story has been far murkier this year.

Muddled 2023 Year-to-Date Performance Underneath the "Big Seven"

Source: FactSet as of September 30, 2023. "Big Seven" includes Microsoft, Apple, Alphabet, Amazon, Tesla, Meta Platforms and Nvidia. Past performance is no guarantee of future results. For illustrative purposes only and should not be construed as a recommendation or solicitation to buy or sell any security. It is not possible to directly invest in an index.

It may surprise many that, on a three-year annualized basis, value is outperforming growth by over 3% (comparing Russell 1000 Value Index to Russell 1000 Growth Index returns over three years, as of September 30, 2023). Looking back further at the past century, seeking out undervalued securities has continuously paid off.3 The last decade of zero-to-negative real rates (in which growth thrived) was the anomaly.

We believe all investors have behavioral biases. We have written about the library of portfolio exercises we perform as a team to combat these biases and promote longer-term idea generation.

We seek to guard against recency bias, among others. Studies have shown that people are prone to make decisions based on recent events, which in markets sometimes hold more weight than a longer-term view. We believe many investors focused on recency this year, as the Magnificent Seven is up 52.2% year-to-date, but these stocks are now expensively trading at an average of 53.6x P/E. AI could be game-changing, but we believe these stocks must prove their benefits for the user and technology providers.

Moreover, the success of these stocks has caused large concentration within top companies in a number of major indexes (Russell 1000 Growth Index has 51.25% of its weight in the top 10 companies by market capitalization and S&P 500 Index has 30.71%). In contrast, only 17.86% of Russell 1000 Value Index companies are in the top 10 by market capitalization. We believe that for Value in particular, there is still a great deal of potential to add value for clients beyond those "top 10" companies, offering significant opportunity for an active manager to select companies and generate alpha for clients over the cycle.

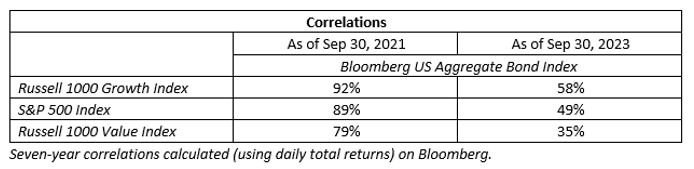

Beyond concentration, most investors now believe in a higher-for-longer regime and having a diverse asset allocation across value and growth is therefore important. We have long spoken about the correlation among various equity indexes and fixed income (represented by the Bloomberg US Aggregate Bond Index). Heading into 2022, based on correlations between broad indexes, we warned investors invested in a typical 60/40 portfolio that they lacked a diverse asset mix. While the numbers have shifted over the last two years, it remains clear that maintaining value in your portfolio offers more diversification than indexing for a core U.S. equity exposure.

Bottom line: We are in a new regime where higher-for-longer is likely and risk has a cost. We believe a diversified allocation is essential in this increasingly unpredictable environment. Our opportunistic value investment philosophy focuses on quality, leading companies that are mispriced or misunderstood by the market and are trading at a discount to their intrinsic value.

1 "Value" and "Growth" are represented by the Russell 1000 Value Index and Russell 1000 Growth Index.

2 The term "Magnificent Seven" was coined by Bank of America analyst Michael Hartnett in reference to the seven heavyweights in the S&P 500 index: Microsoft (MSFT), Apple, Alphabet, Amazon, Tesla, Meta Platforms, and Nvidia.

3 Source: Fama & French [Kenneth R. French Data Library], based on Fama & French's HML Factor model cumulative monthly returns from 1926 to 2022; Eaton Vance research.